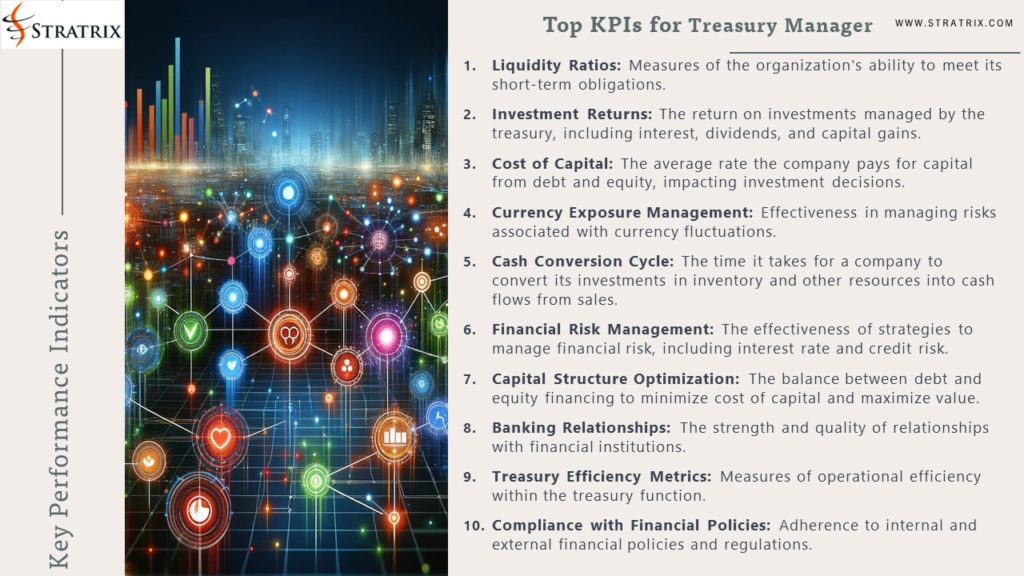

Top KPIs for Treasury Manager

1.Liquidity Ratios: Measures of the organization’s ability to meet its short-term obligations.

2.Investment Returns: The return on investments managed by the treasury, including interest, dividends, and capital gains.

3.Cost of Capital: The average rate the company pays for capital from debt and equity, impacting investment decisions.

4.Currency Exposure Management: Effectiveness in managing risks associated with currency fluctuations.

5.Cash Conversion Cycle: The time it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

6.Financial Risk Management: The effectiveness of strategies to manage financial risk, including interest rate and credit risk.

7.Capital Structure Optimization: The balance between debt and equity financing to minimize cost of capital and maximize value.

8.Banking Relationships: The strength and quality of relationships with financial institutions.

9.Treasury Efficiency Metrics: Measures of operational efficiency within the treasury function.

10.Compliance with Financial Policies: Adherence to internal and external financial policies and regulations.