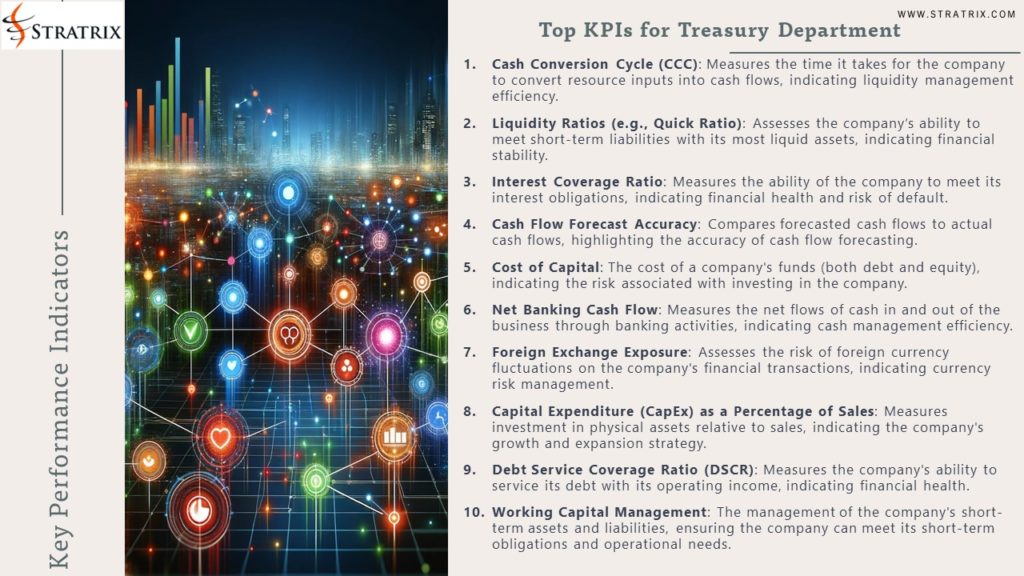

Top KPIs for Treasury Department

1.Cash Conversion Cycle (CCC): Measures the time it takes for the company to convert resource inputs into cash flows, indicating liquidity management efficiency.

2.Liquidity Ratios (e.g., Quick Ratio): Assesses the company’s ability to meet short-term liabilities with its most liquid assets, indicating financial stability.

3.Interest Coverage Ratio: Measures the ability of the company to meet its interest obligations, indicating financial health and risk of default.

4.Cash Flow Forecast Accuracy: Compares forecasted cash flows to actual cash flows, highlighting the accuracy of cash flow forecasting.

5.Cost of Capital: The cost of a company’s funds (both debt and equity), indicating the risk associated with investing in the company.

6.Net Banking Cash Flow: Measures the net flows of cash in and out of the business through banking activities, indicating cash management efficiency.

7.Foreign Exchange Exposure: Assesses the risk of foreign currency fluctuations on the company’s financial transactions, indicating currency risk management.

8.Capital Expenditure (CapEx) as a Percentage of Sales: Measures investment in physical assets relative to sales, indicating the company’s growth and expansion strategy.

9.Debt Service Coverage Ratio (DSCR): Measures the company’s ability to service its debt with its operating income, indicating financial health.

10.Working Capital Management: The management of the company’s short-term assets and liabilities, ensuring the company can meet its short-term obligations and operational needs.