The Boomerang CEO Phenomenon: Analyzing Leadership, Succession, and Corporate Governance.

In the ever-evolving landscape of corporate leadership, the phenomenon of founders and former CEOs returning to their companies has become increasingly common. High-profile examples such as Kevin Plank at Under Armour, Howard Schultz at Starbucks, and Bob Iger at Disney illustrate a broader trend. This recurring cycle of leaders returning to the helm of their companies raises critical questions about leadership succession, the dynamics within the executive suite, and the overall state of corporate governance.

The Challenge of Choosing a Suitable Successor

One of the most significant implications of the boomerang CEO phenomenon is the apparent difficulty in selecting and grooming a suitable successor. A rigorous selection process often accompanies the decision to step down to ensure continuity and stability. However, the return of former leaders suggests that these processes may not always yield the desired results.

Factors Contributing to Succession Challenges:

- Vision Misalignment: Successors may have a different vision for the company that conflicts with the founder’s established direction. This misalignment can lead to strategic discord and operational inefficiencies, prompting the return of the former leader to restore their original vision.

- Cultural Fit: A successor who does not fit well with the company’s culture can struggle to gain the trust and cooperation of the existing workforce. Founders and former CEOs often embody the company’s ethos, making it difficult for new leaders to fill their shoes.

- Operational Expertise: Modern businesses are complex and require leaders with a deep understanding of their operations. Founders and former CEOs, with their extensive experience, may feel that their successors lack the necessary operational expertise to navigate challenges effectively.

The Impact on New Leadership and Team Development

When a former CEO or founder remains actively involved behind the scenes, it can significantly impact the new leadership team’s ability to grow and flourish. This dynamic can manifest in several ways:

- Second-Guessing and Micromanagement: If the former leader frequently intervenes or questions the new CEO’s decisions, it can undermine their authority and confidence. This second-guessing can create a climate of uncertainty and hinder decisive leadership.

- Stunted Leadership Development: The presence of a powerful predecessor can overshadow the new leader, preventing them from fully developing their leadership style and capabilities. This can lead to a dependency on the former leader, inhibiting the new CEO’s ability to innovate and drive change.

- Team Morale and Cohesion: The perception that the new CEO is not entirely in control can affect team morale and cohesion. Employees may feel torn between loyalty to the former leader and the need to support the new CEO, leading to internal friction and reduced productivity.

Corporate Governance and Board Independence

The return of former leaders also raises questions about the effectiveness of corporate governance and the independence of boards. Ideally, a board of directors should act in the company’s and its shareholders’ best interest, providing oversight and ensuring effective leadership transitions. However, reappointing former CEOs can suggest potential weaknesses in this governance structure.

Key Governance Concerns:

- Board Independence: Boards’ willingness to reappoint former leaders may indicate a lack of independence. Boards dominated by members with close ties to the founder or former CEO might prioritize personal relationships over objective decision-making.

- Succession Planning: Effective succession planning is a critical aspect of corporate governance. The return of former leaders could signify that succession planning processes were inadequate or not properly executed, raising concerns about the board’s strategic oversight capabilities.

- Crisis Management: Boards may bring former leaders back during crises, believing that their familiarity with the company can provide stability. While this can be a short-term solution, it may also reflect a lack of confidence in the board’s ability to manage crises without reverting to past leadership.

Case Studies and Lessons Learned

To further illustrate these points, examining specific cases of boomerang CEOs can provide valuable insights.

Kevin Plank and Under Armour:

Kevin Plank, the founder of Under Armour, returned to a more active role in the company after stepping down as CEO. Plank’s return was driven by a need to address strategic missteps and declining financial performance. His intimate knowledge of the brand and its culture made him a natural choice to steer the company back on track. However, this also highlighted the challenges in finding a successor who could match his deep connection to the company.

Howard Schultz and Starbucks:

Howard Schultz’s multiple returns to Starbucks demonstrate both the benefits and challenges of the boomerang CEO phenomenon. Schultz’s return was often associated with periods of revitalization and innovation, such as introducing new product lines and expanding into new markets. However, his involvement also raised questions about the company’s ability to sustain its success without his direct influence, pointing to potential gaps in leadership development and succession planning.

Bob Iger and Disney:

Bob Iger’s return to Disney is another notable example. After initially stepping down, Iger returned to address strategic challenges and oversee critical initiatives such as the launch of Disney+. His return underscored the value of his experience and vision but highlighted the difficulties in transitioning to a new leadership team capable of sustaining the company’s momentum.

Strategies for Effective Leadership Transitions

To mitigate the issues associated with the boomerang CEO phenomenon, companies can adopt several strategies to ensure smoother leadership transitions and stronger corporate governance:

- Robust Succession Planning: Developing a comprehensive succession plan with mentorship and gradual transition periods can help prepare successors more effectively. This plan should involve regular assessments and adjustments to ensure alignment with the company’s evolving needs.

- Fostering Leadership Development: Investing in leadership development programs can equip potential successors with the necessary skills and experience. Providing opportunities for emerging leaders to take on significant responsibilities can build their confidence and competence.

- Enhancing Board Independence: Ensuring a diverse and independent board can improve governance practices. Board members with vast expertise and perspectives can provide more objective oversight and strategic guidance.

- Clear Communication and Role Definition: Establishing clear roles and boundaries between the former and new CEOs can prevent overlaps and conflicts. Open communication channels facilitate a smoother transition and foster mutual respect and collaboration.

- Emphasizing Cultural Continuity: While new leaders may bring fresh perspectives, it is essential to maintain continuity in the company’s core values and culture. A balanced approach that respects the company’s heritage while encouraging innovation can create a more harmonious transition.

The return of boomerang CEOs to their companies is a multifaceted phenomenon with significant implications for leadership, succession, and corporate governance. While the return of experienced leaders can provide stability and strategic direction during challenging times, it also highlights potential weaknesses in succession planning and governance structures. By adopting robust strategies for leadership development, succession planning, and board independence, companies can better navigate these transitions and ensure long-term success. Ultimately, the goal should be to create a leadership framework that balances continuity with innovation, enabling the company and its leaders to thrive.

____________________

The Boomerang CEO Phenomenon: Best Practices for Corporate Boards

-

Develop a Comprehensive Succession Plan:

-

- Actionable Steps:

-

-

- Start succession planning well in advance to avoid rushed decisions.

- Include both short-term emergency plans and long-term strategic plans.

- Regularly update the plan to reflect changes in company strategy and market conditions.

-

-

- Benefits:

-

-

- Ensures continuity in leadership during transitions.

- Aligns the successor’s skills and vision with the company’s future needs.

-

-

Conduct Thorough Internal and External Candidate Assessments:

-

- Actionable Steps:

-

-

- Evaluate internal candidates through performance reviews, leadership assessments, and career development programs.

- Benchmark internal candidates against external talent to ensure a broad perspective.

- Use external consultants if needed to provide objective evaluations.

-

-

- Benefits:

-

-

- Identifies the best fit for the company’s strategic direction.

- Provides a comprehensive view of available talent.

-

-

Foster Leadership Development and Mentorship Programs:

-

- Actionable Steps:

-

-

- Implement leadership development programs to prepare internal candidates.

- Encourage current CEOs to mentor potential successors, providing them with firsthand experience and knowledge.

- Offer rotational assignments to expose potential successors to different aspects of the business.

-

-

- Benefits:

-

-

- Builds a robust internal pipeline of capable leaders.

- Ensures that potential successors are well-rounded and experienced.

-

-

Ensure Board Independence and Diversity:

-

- Actionable Steps:

-

-

- Maintain a board composition with diverse backgrounds, expertise, and perspectives to enhance decision-making.

- Foster independence by minimizing conflicts of interest and ensuring that board members can objectively evaluate succession candidates.

- Regularly review and update governance practices to align with best practices.

-

-

- Benefits:

-

-

- Promotes objective and balanced decision-making.

- Enhances the credibility and integrity of the succession process.

-

-

Engage in Transparent and Open Communication:

-

- Actionable Steps:

-

-

- Communicate clearly and regularly with stakeholders about the succession planning process and timelines.

- Involve key stakeholders, including senior management and shareholders, in discussions about succession.

- Provide clear criteria and rationale for selecting the new CEO to avoid misunderstandings and build trust.

-

-

- Benefits:

-

-

- Builds confidence and trust among stakeholders.

- Reduces uncertainty and ensures a smooth transition.

-

Additional Considerations

- Regularly Review and Adjust Succession Plans: As the business environment and company strategy evolve, succession plans should be revisited and updated to stay relevant.

- Performance Metrics: Establish clear performance metrics for potential successors to track their readiness and suitability for the role.

- Crisis Management: To ensure continuity and stability, have a clear plan for interim leadership in case of sudden departures.

By adhering to these best practices, corporate boards can effectively navigate the complexities of CEO succession, ensuring that the chosen leaders are well-prepared to drive the company’s future success.

______________

The Boomerang CEO Phenomenon: 10 Ways Former CEOs Can Support New Leadership Without Being Overbearing

-

Transition Gracefully:

-

- Actionable Steps: Formally announce the transition, highlighting the new CEO’s capabilities and your support for them. Be clear about your role and commitment to the company’s future under the new leadership.

- Benefits: Sets a positive tone and reinforces confidence in the new leadership.

-

Serve as an Advisor, Not a Supervisor:

-

- Actionable Steps: Offer your expertise and insights when requested, but avoid unsolicited advice. Maintain a supportive yet hands-off approach.

- Benefits: Provides valuable insights without undermining the new CEO’s authority.

-

Respect Boundaries:

-

- Actionable Steps: Clearly define your new role and stick to it. Avoid involving yourself in day-to-day operations or decision-making processes unless explicitly asked.

- Benefits: Ensures the new CEO has the space to lead and make decisions independently.

-

Promote Collaboration:

-

- Actionable Steps: Encourage open communication and collaboration between the new CEO and the executive team. Facilitate introductions and provide context for critical relationships.

- Benefits: Helps the new CEO build strong internal and external networks.

-

Mentor with Discretion:

-

- Actionable Steps: Offer to mentor the new CEO, focusing on sharing experiences and lessons learned. Be available for periodic check-ins rather than constant oversight.

- Benefits: Provides guidance while allowing the new CEO to grow into the role.

-

Champion the New Leadership:

-

- Actionable Steps: Publicly endorse and support the new CEO in communications with employees, investors, and the media. Emphasize their strengths and your confidence in their leadership.

- Benefits: Reinforces the legitimacy of the new CEO and boosts stakeholder confidence.

-

Facilitate Knowledge Transfer:

-

- Actionable Steps: Share critical knowledge about company culture, strategic initiatives, and key stakeholders. Ensure a comprehensive handover of ongoing projects and future plans.

- Benefits: Equips the new CEO with the information needed to make informed decisions.

-

Focus on Strategic Initiatives:

-

- Actionable Steps: If staying on in an official capacity, take on strategic projects that align with your expertise but do not interfere with the new CEO’s responsibilities.

- Benefits: Contributes to the company’s success while respecting the new leadership structure.

-

Support Organizational Change:

-

- Actionable Steps: Advocate for any organizational changes initiated by the new CEO. Provide historical context and support the rationale behind these changes.

- Benefits: Eases the implementation of new strategies and fosters a culture of adaptability.

-

Plan for Your Role’s Evolution:

-

- Actionable Steps: Work with the board and the new CEO to clearly outline your evolving role over time. Establish a timeline for gradually reducing your involvement.

- Benefits: Ensures a smooth transition and sets clear expectations for all parties.

The transition of leadership can be a delicate period for any organization. Former CEOs have a wealth of experience and knowledge that can be invaluable to their successors. By following these practices, former CEOs can support new leadership effectively, fostering a smooth transition and ensuring the company’s continued success without overshadowing or undermining the new CEO’s authority.

_______________

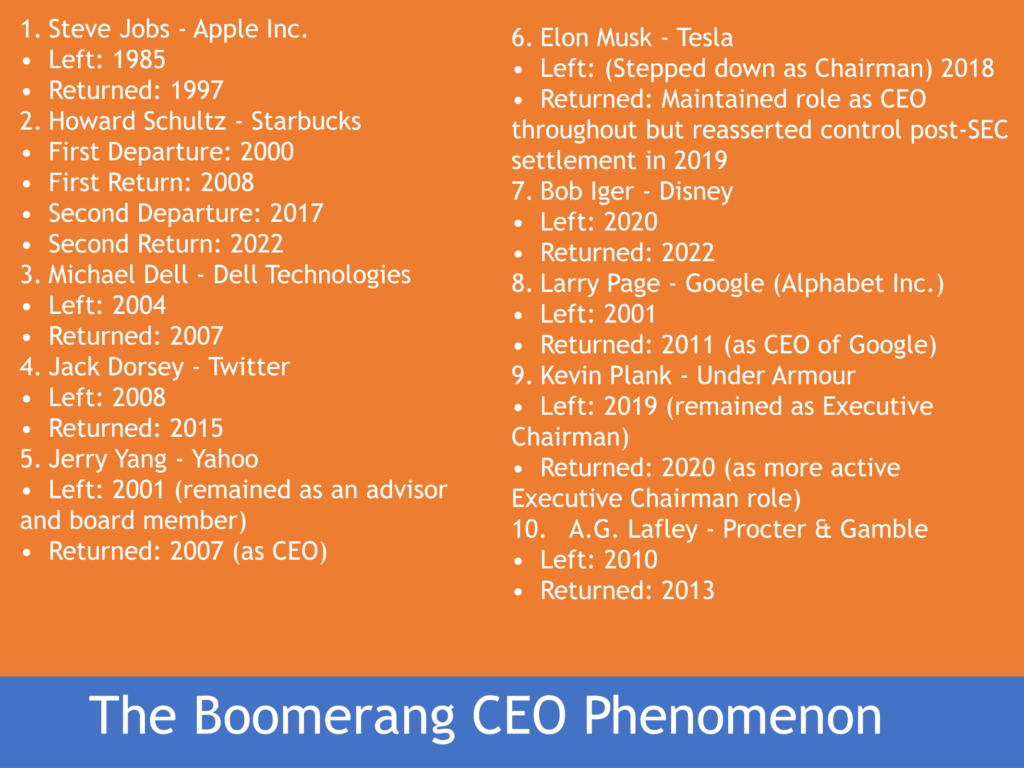

The Boomerang CEO Phenomenon: Recent Examples of Boomerangs

- Steve Jobs – Apple Inc.

-

- Left: 1985

- Returned: 1997

- Howard Schultz – Starbucks

-

- First Departure: 2000

- First Return: 2008

- Second Departure: 2017

- Second Return: 2022

- Michael Dell – Dell Technologies

-

- Left: 2004

- Returned: 2007

- Jack Dorsey – Twitter

-

- Left: 2008

- Returned: 2015

- Jerry Yang – Yahoo

-

- Left: 2001 (remained as an advisor and board member)

- Returned: 2007 (as CEO)

- Elon Musk – Tesla

-

- Left: (Stepped down as Chairman) 2018

- Returned: Maintained role as CEO throughout but reasserted control post-SEC settlement in 2019

- Bob Iger – Disney

-

- Left: 2020

- Returned: 2022

- Larry Page – Google (Alphabet Inc.)

-

- Left: 2001

- Returned: 2011 (as CEO of Google)

- Kevin Plank – Under Armour

-

- Left: 2019 (remained as Executive Chairman)

- Returned: 2020 (as more active Executive Chairman role)

- A.G. Lafley – Procter & Gamble

-

- Left: 2010

- Returned: 2013