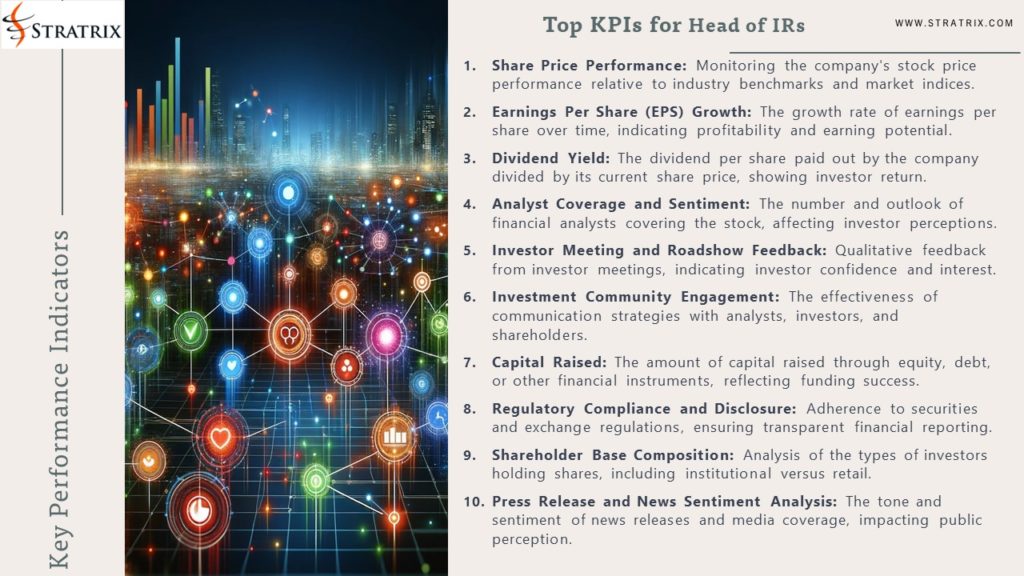

Top KPIs for Head of IRs

1.Share Price Performance: Monitoring the company’s stock price performance relative to industry benchmarks and market indices.

2.Earnings Per Share (EPS) Growth: The growth rate of earnings per share over time, indicating profitability and earning potential.

3.Dividend Yield: The dividend per share paid out by the company divided by its current share price, showing investor return.

4.Analyst Coverage and Sentiment: The number and outlook of financial analysts covering the stock, affecting investor perceptions.

5.Investor Meeting and Roadshow Feedback: Qualitative feedback from investor meetings, indicating investor confidence and interest.

6.Investment Community Engagement: The effectiveness of communication strategies with analysts, investors, and shareholders.

7.Capital Raised: The amount of capital raised through equity, debt, or other financial instruments, reflecting funding success.

8.Regulatory Compliance and Disclosure: Adherence to securities and exchange regulations, ensuring transparent financial reporting.

9.Shareholder Base Composition: Analysis of the types of investors holding shares, including institutional versus retail.

10.Press Release and News Sentiment Analysis: The tone and sentiment of news releases and media coverage, impacting public perception.