Chasing every opportunity and ogling at every shiny object dissipates strategic focus and spreads the company’s resources thin. Often, chasing every opportunity results in deviating so much from the core that the company fails to achieve the strategic goals it set forth.

Let’s first define what chasing every opportunity means?

Companies, particularly startups, are often hungry to generate revenue and prove their mettle in the marketplace. They may start to provide a particular set of products or services to a specific segment of customers. But often they notice a disparate opportunity, and immediately allocate resources to pursue it.

For example, ShineChaser is a technology startup with venture funding exceeding $10 million. The company started as a healthcare SAAS software provider and then noticed that the understaffing of various IT resources. They immediately began to provide bodies for short-term revenue. The staffing business never became significant or material, and ShineChaser did not have any unique competencies in the area. So, this was a distraction without a clear destination.

Next, ShineChaser sales team also came across another area – the back office outsourcing. Undeterred by a lack of scale and success in the staffing business, they started a BPO (Business Process Outsourcing) operation for the sake of one opportunity at a specific customer. What the company thought was a simple lift and shift became a nightmare to transition and scale. After two-years of band-aids on the operation, the client pulled the plug on the outsourcing contract.

Meanwhile, the company’s core application development efforts took a backseat, and the ensuing delays and shortcomings of the product proved costly.

The investors were also not forgiving given the two utterly random bets, which caused ShineChaser to drop the ball on the core and never established itself in either of two diversifications.

Why did ShineChaser lose its strategic focus? In two words – Tactical Opportunism. The opportunities the company pursued are not a part of the founding team’s core competency, and both the fields are highly competitive with well-established firms – big and small. Without a clear plan and path to add new clients and build out the business, the company’s efforts were suboptimal, and the impact on the core business was disastrous.

Of course, there is a difference between chasing every opportunity versus a pivot or strategic opportunism. CEOs (Chief Executive Officers) should consider emerging trends and opportunities and match them to the company’s mission, vision, goals, people, capabilities, and competencies.

A pivot may be a necessary part of corporate evolution through various phases of its life cycle. Identifying Greenfield opportunities or strategic pivots is an essential skill of survival. But one has to commit to an axis after careful consideration of the opportunity space, competitive landscape, and the unique value proposition their firm can bring to bear. This may include product/service adjacencies and sometimes a leap into an entirely different space based on fundamentals.

For example, Amazon started as an online e-commerce store and then transformed into a marketplace. Then after seeing the struggles of other retailers, Amazon began offering its platform. And later came the launch of Amazon Webservices (AWS), which established an entirely new category of business and has become a juggernaut in its own right with revenues over $35 billion in 2019. AWS itself would qualify to be a Fortune 500 company and occupy the number 94 or 95 spot.

Chasing Every Opportunity: A simple evaluation framework before considering an opportunity

It would behoove founders and executives to evaluate their options objectively before embarking on any strategic diversification and pivots and reduce the fallacy of chasing every opportunity

It would behoove founders and executives to evaluate their options objectively before embarking on any strategic diversification and pivots and reduce the fallacy of chasing every opportunity

- Take inventory of your enterprise capabilities and competencies.

- Identify the opportunity set under consideration.

- Assess the market opportunity based on empirical data.

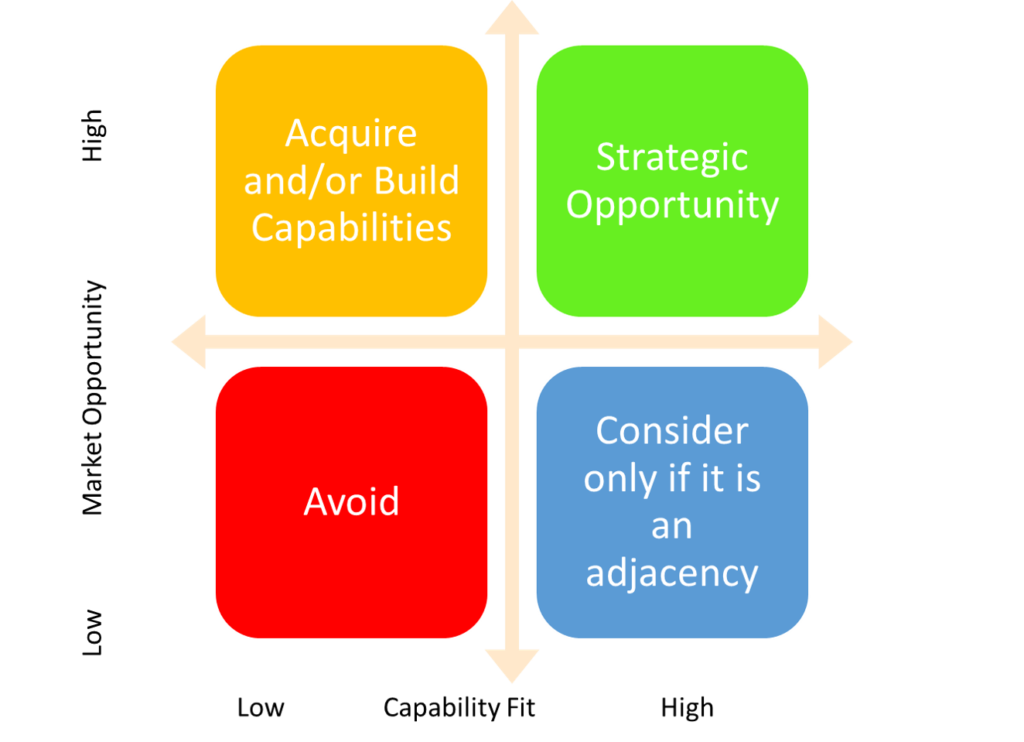

- Plot a 2*2 grid – with Capability Fit on X-axis and the Market Opportunity on the Y-axis.

- Place the opportunities on the appropriate quadrants on the grid. The analysis for where things belong should be based on objective criteria and preferably a Delphi method or a weighted scoring.

- The right top quadrant is the most optimal opportunities. The bottom right opportunities may be appropriate if they are low hanging fruit and fit in with a product/service adjacency. The left bottom quadrant is a classic dog. The left top quadrant may only be a viable option if the opportunity is so massive your company is willing to build or acquire such capabilities and competencies.