Changing strategy during a crisis such as a severe recession or crisis is a temptation few corporate strategists and CXOs can resist. Any black swan event is a cataclysmic experience, and to survive and hopefully thrive in the future, executives tend to think switching gears and changing core strategy is a winning play.

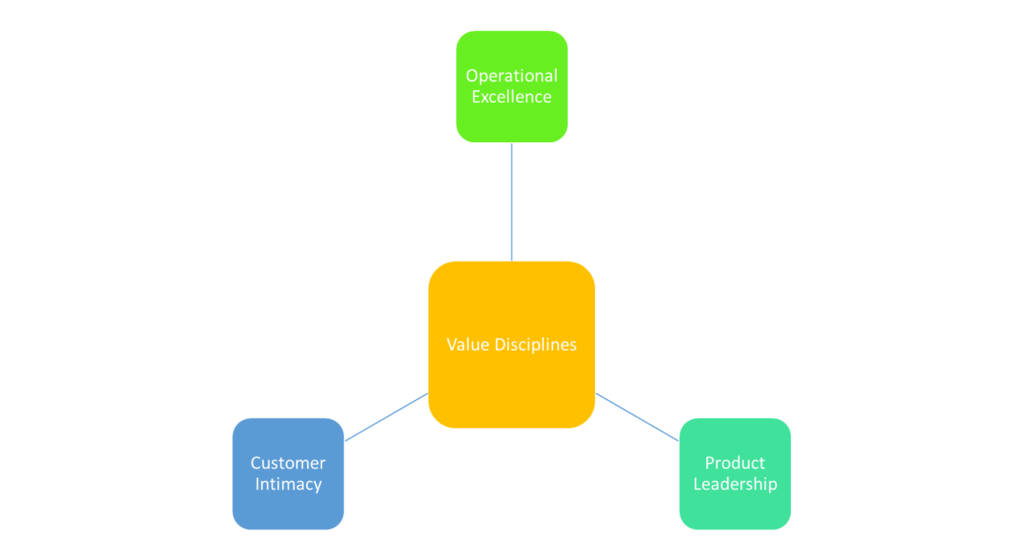

While specific underlying strategies of each company may vary, broadly, the core strategy of a firm may fall into one of the three value disciplines proposed by Tracy and Wiersema.

Changing Strategy during a Crisis: Possibilities and Pitfalls

In their famous book, The Discipline of Market Leaders, the authors propose three value disciplines.

- Operational Excellence

- Product Leadership and

- Customer Intimacy

To achieve success, it is seldom a company can be a leader in all disciplines.

The authors also propose some rules for the road for corporate strategies and CXOs who are trying to pick a strategy lane.

- Try to be the best by excelling in one of the value disciplines. …

- Maintain threshold standards on other value disciplines. …

- Control the market by improving value year after year. …

- Support the value discipline you have opted for by delivering a well-chosen (operating) organizational model.

For example, companies that focus on operational excellence excel at lower price points, variety in the product range, and an efficient supply chain. A firm like Walmart is a showcase of operational excellence.

From a product leadership perspective, Apple is at the top of the list for premium-priced and genre-defining products that customers love.

And companies like Starbucks and Zappos are great examples of leadership built on customer intimacy.

So why are tough times not necessarily the optimal moment to change strategy?

The answer boils down to three things a) prevailing company culture b) customer perceptions and c) time it takes to change genuinely.

Why Switching from Product Leadership to Operational Excellence and Competing on Cost is seldom possible?

Let’s assume are the chief strategy offer of a firm that prides itself on cutting edge R&D, exceptional design, and branding capabilities and is known for brands customers like to flaunt.

Now your company decides that in the face of a severe financial crisis and recession, customers no longer want to buy a high-priced item that their heart desires but their head disavows. And as a remedy, you embark on a strategy shift and want to become a low-cost provider.

Do you think it is simple to change strategy on a PowerPoint and then turn it into a winning game plan? Think again.

Your low-cost competitors and their supply chains are in place long before the recession. The assortment of products, the branding, the distribution, and sales are all low friction sales.

Does your company stand a chance to do the following?

- Erase the premium positioning your company, and its products have long-established and become a low-cost purveyor?

- Are you capable of replicating the cheaper suppliers and assembly/manufacturing facilities that quickly?

- And how do your employees, the existing capabilities, and the prevailing culture adjust to such drastic change?

Switching from Operational Excellence and Cost Leadership to Product Leadership:

On the other hand, let’s assume your company is a leader in operational excellence and providing products and services at a low price and a large assortment.

Now, considering the low margins and the supply chain disruptions due to a crisis such as COVID-19, you decide moving up the chain to a premium price, high-value products are the vital strategy shift.

Frequently, it is tough to move from a low-cost provider to a premium product purveyor.

Let’s take the example of a dollar store where things sell below $5 or $10 apiece. The store locations, layout, the expertise and skill level of the staff, the demographics and income of the customers, and the positioning/perception among the clientele is not going to change overnight. Assuming you want to sell a 1000 dollar watch, is it possible to do so without a knowledgeable counter sales team, and also is that product congruent with the rest of the product assortment?

Changing strategy during a crisis and executing such as a shift in the face of a recession where one has to focus on survival and not make risky moves is rather challenging.

While it may look good on paper, changing strategy in the face of swirling storms seldom succeeds.

Alternatives to Changing Strategy during a Crisis:

So, what should you do if you are a high-cost product leader and are facing headwinds due to the COVID-19 pandemic?

- Hunker down and hold the fort

Ensure that your company is building its resilience and leaning heavily on existing capabilities and strengths. In times like this, taking significant risks and making catastrophic mistakes is what derails companies. So it is time to hunker down, try to make your moats more robust and reliable, and wait for better days. Avoid expensive product launches and risky bets.

- If possible, strengthen the competitive position.

There are occasions when an opportunity arises to build on your competitive advantage. For example, major retailers like Target, Walmart, and notably, Amazon have expanded their footprint and strengthened their competitive position in the market.

Similarly, companies like Zoom have cashed in on the work from the home phenomenon.

If such a situation presents, they don’t hesitate to take advantage.

- Conserve cash and keep financial lifelines open

Draw on your credit lines—cash in your chips. Negotiate with your suppliers. Focus on accounts receivables. A strong financial position, a clean balance sheet, and the ability to tap into credit lines and other short-term paper are crucial. As a CFO of a company reeling under the severity of the recession, don’t’ wait until the doors close. Be alert and be proactive in securing financial support to last through the downturn.

- Be open to corporate development opportunities.

This tactic may fly contrary to the hunkering down and holding fort approach, but sometimes great opportunities present themselves. If you are in a position of strength, an acquisition by your firm may be a lifeline to a competitor.

For example, in the great recession of 2008-2009, companies like Bank of America and JP Morgan strengthened their franchises by acquiring marquis names for pennies on the dollar. (Bank of America’s rescue of Merrill Lynch and its thundering herd and JP Morgan’s acquisition of Bear Stearns fall into this category.)

So, as a corporate development officer, keep an eye open for distressed competitors or firms in product/service adjacencies that would be complementary to your market position and drive future growth. Or if your firm is the one in distress, ensure you are spreading the word far and wide and way in advance so that you are not subject to a fire sale.

While a wholesale changing strategy during a crisis is not advisable, there are subtle shifts and strategic moves that a company can make to advance its cause, shelter itself from harm, and be opportunistic when occasions demand.

Are you considering changing your strategy during a crisis such as the COVID-19? What options and alternatives are you contemplating?