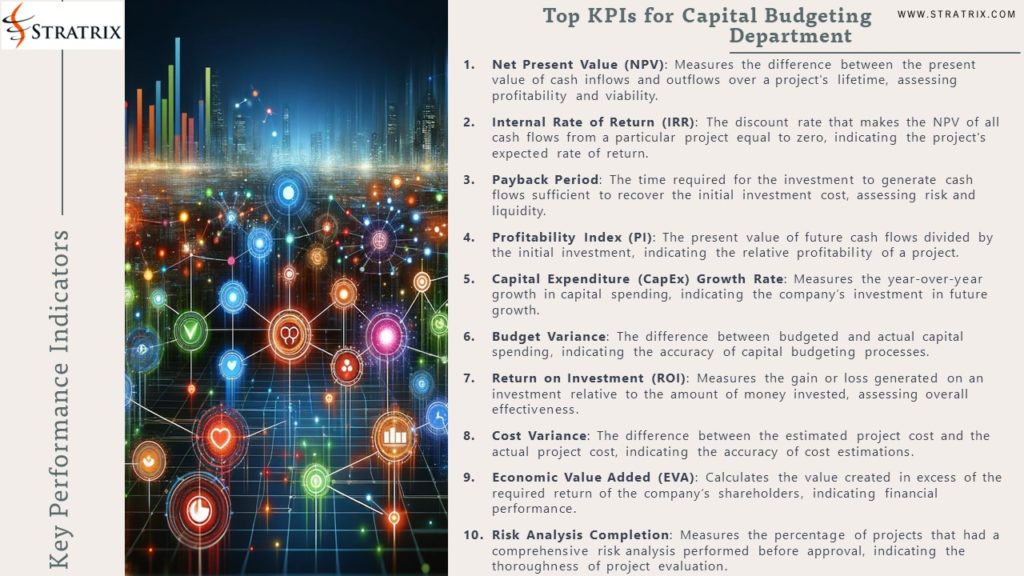

Top KPIs for Capital Budgeting Department

1.Net Present Value (NPV): Measures the difference between the present value of cash inflows and outflows over a project’s lifetime, assessing profitability and viability.

2.Internal Rate of Return (IRR): The discount rate that makes the NPV of all cash flows from a particular project equal to zero, indicating the project’s expected rate of return.

3.Payback Period: The time required for the investment to generate cash flows sufficient to recover the initial investment cost, assessing risk and liquidity.

4.Profitability Index (PI): The present value of future cash flows divided by the initial investment, indicating the relative profitability of a project.

5.Capital Expenditure (CapEx) Growth Rate: Measures the year-over-year growth in capital spending, indicating the company’s investment in future growth.

6.Budget Variance: The difference between budgeted and actual capital spending, indicating the accuracy of capital budgeting processes.

7.Return on Investment (ROI): Measures the gain or loss generated on an investment relative to the amount of money invested, assessing overall effectiveness.

8.Cost Variance: The difference between the estimated project cost and the actual project cost, indicating the accuracy of cost estimations.

9.Economic Value Added (EVA): Calculates the value created in excess of the required return of the company’s shareholders, indicating financial performance.

10.Risk Analysis Completion: Measures the percentage of projects that had a comprehensive risk analysis performed before approval, indicating the thoroughness of project evaluation.