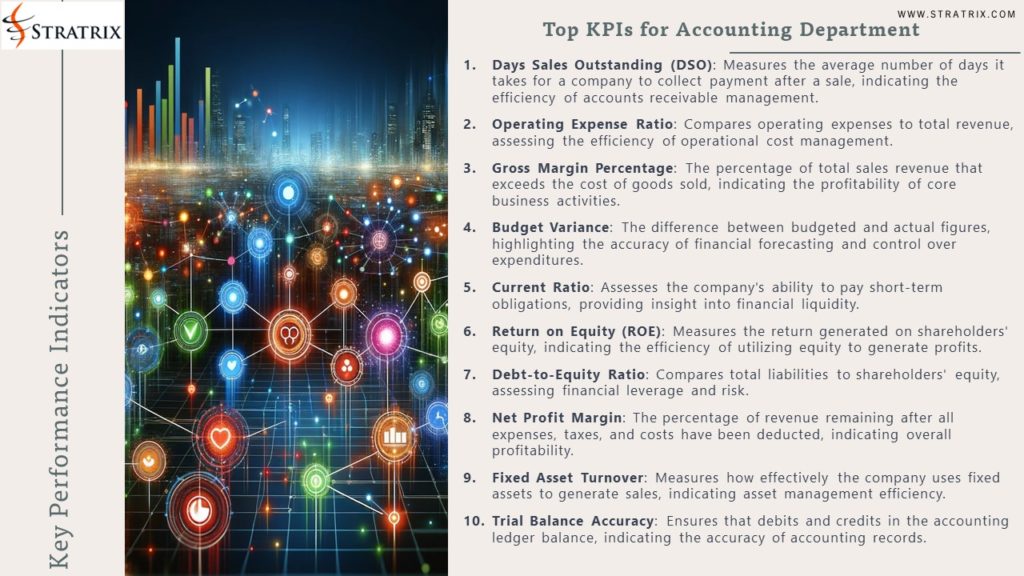

Top KPIs for Accounting Department

1.Days Sales Outstanding (DSO): Measures the average number of days it takes for a company to collect payment after a sale, indicating the efficiency of accounts receivable management.

2.Operating Expense Ratio: Compares operating expenses to total revenue, assessing the efficiency of operational cost management.

3.Gross Margin Percentage: The percentage of total sales revenue that exceeds the cost of goods sold, indicating the profitability of core business activities.

4.Budget Variance: The difference between budgeted and actual figures, highlighting the accuracy of financial forecasting and control over expenditures.

5.Current Ratio: Assesses the company’s ability to pay short-term obligations, providing insight into financial liquidity.

6.Return on Equity (ROE): Measures the return generated on shareholders’ equity, indicating the efficiency of utilizing equity to generate profits.

7.Debt-to-Equity Ratio: Compares total liabilities to shareholders’ equity, assessing financial leverage and risk.

8.Net Profit Margin: The percentage of revenue remaining after all expenses, taxes, and costs have been deducted, indicating overall profitability.

9.Fixed Asset Turnover: Measures how effectively the company uses fixed assets to generate sales, indicating asset management efficiency.

10.Trial Balance Accuracy: Ensures that debits and credits in the accounting ledger balance, indicating the accuracy of accounting records.